Soy Checkoff Delivers Results on International Stage

Todd Hanten was all smiles as his boots slid in the mud. A short drive to his soybean fields revealed a much-needed rain soaked his soybeans with about half an inch of moisture.

“That should get them through the end of the month,” Hanten, a soy checkoff farmer-leader from Goodwin, South Dakota, says as his fears of drought soaked into the soil along with the steady precipitation.

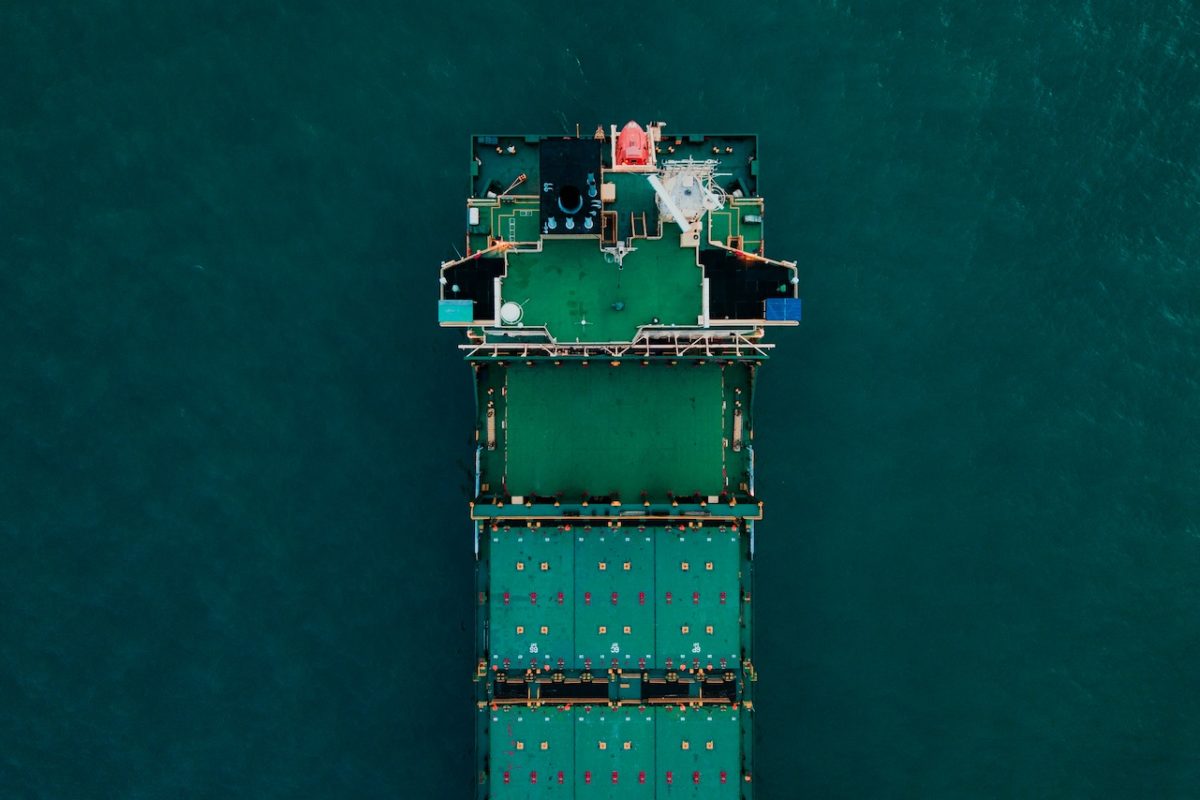

Continued rains across the U.S. will help ensure a good crop this year, and your soy checkoff will do its part to find a home for what is expected to be a strong crop. This fiscal year, U.S. farmers are expected to export a record $28.9 billion of soybeans, according to U.S. Department of Agriculture forecasts, due to surging demand from China and tight stocks. The soy will be transported worldwide to help countries including China, Mexico, Bangladesh and Indonesia feed billions of people.

The U.S. Soybean Export Council, working to maximize the use of U.S. soy internationally, continues to diversify global markets and build a preference for U.S. soybeans. The work has been paying off as new markets have emerged amid shifting trade ties with China, which remains the No. 1 global importer of soybeans from the U.S., South America and other areas at 60%.

“Anybody in business doesn’t want to have too many of their eggs in one basket. The more broadly we can diversify the customers of U.S. soy around the world, I think the better for our soybean farmers,” Jim Sutter, the chief executive officer of USSEC, says. “It’s really important that we go to new markets and help to the extent that we can with education and with our promotional work. But while we are there, we also want to differentiate and build a preference for U.S. soy.”

Mac Marshall, vice president of market intelligence for the soy checkoff and USSEC, points out that the U.S. moved more volume to Mexico during trade frictions with China. Those markets continue to be important even as China ramps up imports again.

“I think it’s worth noting that we’ve got exciting new things popping up,” he says. “For example, we saw soybean meal sales to the Ivory Coast for the first time this season and sales to the West Indies. Those are not big markets, but any time a market pops up where it wasn’t before, that’s exciting.”

Farmers continue to lead the effort to build preference for the soybeans they grow by participating in trade missions to new markets. For example, Dawn Scheier, a farmer in Salem, South Dakota, and secretary with USSEC’s board of directors, believes it is essential to tell the world about soy grown on U.S. farms.

“You want to point out to these customers that we have a better value for them,” she says. “There’s competition out there. You can always buy the cheapest thing, but we have a better value, and we want the customers to know that.”

Greg Greving, a farmer from Chapman, Nebraska, and a checkoff farmer-leader, agrees.

“The Asian people value a contact more than they do a contract,” he says. “We’ve been over there beating the bricks, promoting our soybeans, and we’ve made these contacts. Once you get the contact, the contract will come easy. I’ve seen that time and time again.”

Greving and other farmer volunteers who have participated in trade missions to bolster exports often return to their farms with cellphone numbers from buyers and friendships that last for years.

USSEC continues to work with emerging countries to build U.S. soy preference through education. The quality and dependability of U.S. soy often drive sales.

“If we are there early and we build trust with the local industry and with the local government, we can have a positive impact on market access as time goes by,” Sutter says. “Then the U.S. becomes a trusted supplier, a trusted voice that they can count on, and that’s important.”

The strategy has worked in the past. China is considered a prime example. Next year, the United States will celebrate 40 years of working with the Chinese, supplying them with soybeans and other commodities.

“China will continue to grow their consumption,” Sutter says. “I think they will end up increasing their consumption on an annual basis as their swine herd gets back to normal after the African swine fever situation.”

With all the good news in the industry, there are headwinds for U.S. international marketing. Marshall points out that soybean oil exports are down, due to a surge in domestic demand from biofuels. There are concerns in the industry that the higher prices could impact buyers.

“The soybean oil exports to South Korea are down 20% year on year,” Marshall says. “Across the board, they are down 30%.”

That makes it more important to showcase to international buyers the quality of U.S. soy.

“Fortunately, our farmers across the country are committed to growing a great crop year in and year out,” he says. “Not just one that is high in volume but one that is high in quality. One that can also fit into foreign and domestic uses along with food and industrial uses.”