Record Exports Set the Pace for an Exciting Year

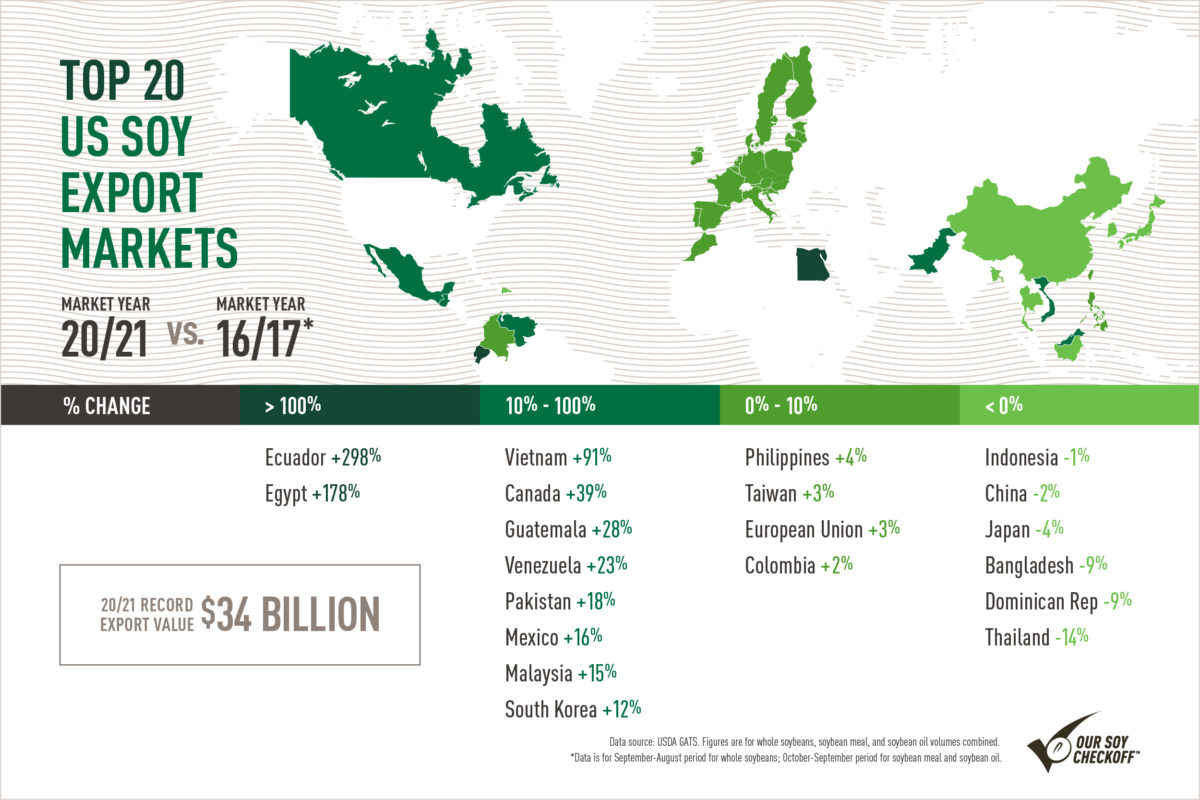

Marketing year 2020/2021 will definitely be one to go down in the soybean history books. According to the USDA’s Global Agricultural Trade System, the U.S. set a volume record for whole soybeans of 61.65 million metric tons (MMT), valued at a record $28.1 billion. For combined beans, meal and oil, we set a volume record of 74.99 MMT, with a record aggregate value of $34.57 billion. And don’t forget that for a very short time back in May, prices climbed to over $16 per bushel, the highest in over a decade. This is all setting the stage for another interesting year.

Mac Marshall, who serves as vice president of market intelligence for USB and USSEC, says what’s most exciting about this isn’t even the numbers — it’s where the growth originates. Soybean farmers, through the checkoff’s investments in promotion, are expanding global markets beyond China as the primary buyer of U.S. soybeans.

“We were able to leverage the experiences that were felt during the period of trade friction between the U.S. and China when we really had to amplify our marketing efforts and programs in a more diversified set of markets, which drove growth in smaller markets that enabled this aggregate figure,” says Marshall.

Doug Winter, Illinois soybean farmer and soy checkoff farmer-leader, knows firsthand how important global demand is for U.S. soybean farmers.

“With approximately 60% of the U.S. soybean crop being exported as some form of soy product, that global demand makes up a large portion of the price we receive for our beans,” says Winter. “I think as farmers we know how important our international customers are to us, and that motivates us to keep improving what we grow to provide them with excellent soy products.”

That Was Then, This Is Now

Although it’s just begun, this marketing year is already shaping up to be a little different than the last. Meal exports are moving at a good pace. From October 1-28, the U.S. shipped over 900,000 metric tons, 4% above last year’s pace and 8% over the five-year average.

“It’s important that we have that strength in overseas demand for U.S. meal because we’re going through a lot of changing dynamics in the industry here in the U.S.,” says Marshall.

Typically, meal contributes about two-thirds of a soybean’s value, with oil contributing the other one-third. However, since the start of calendar year 2021, oil prices are up roughly 40%, which is changing the value proposition when soybeans are processed.

“We’re seeing a surge in demand for soybean oil for use in the biofuel sector, specifically for renewable diesel and sustainable aviation fuel, which has led to an increase in component values for soybean oil,” says Marshall.

Higher Prices, Tighter Margins

Hurricane Ida damage to fertilizer and crop protection production facilities continues to have a negative effect on pricing, pushing input costs higher. Energy costs are also on the rise, with oil reaching $80 a barrel and higher natural gas prices. These factors will influence planting decisions from inputs to crop rotations and could have long-term impacts throughout the growing season.

“As farmers are looking at their budgets and what their rotations are going to look like this year, deciding on one crop over another, the economics are different than it’s been the last couple of years,” says Marshall. “Yes, prices are better, but inflation on the input cost side is potentially a factor that leads to changes in behavior.”

So, does this mean farmers will plant more acres of soybeans in 2022? Time will tell, but this next year is shaping up to be even more interesting than the last.